What is escrow defined:

Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met. The California Escrow Law, Section 17003, provides the complete legal requirements.

What Does an Escrow Company Do:

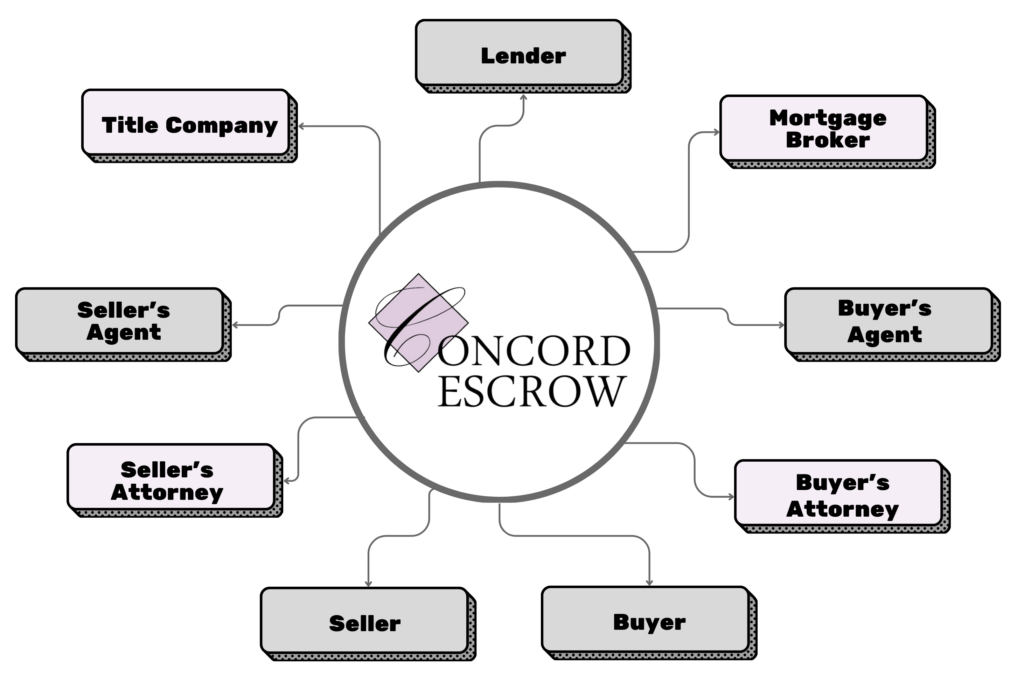

The escrow company acts as a neutral third party in a real estate transaction whose primary role is to protect the interests of all parties involved in the sale. It collects the required funds and documents involved in the closing process, including the initial earnest money funds, the loan documents, and the signed deed and closing funds.

Benefits of escrow:

Escrow companies play a valuable role in safeguarding the interests of both sellers and buyers. From holding earnest money to disbursing funds, they assure that key steps of the transaction are properly executed. This is why working with a reputable escrow company is important when buying or selling a home.

Who selects the escrow company:

The choice of an escrow agent is usually agreed upon by the principals in the real estate purchase contract. While a seller might choose one company and a buyer may select another firm, they must ultimately agree on the specific escrow holder. If a real estate broker is involved in the transaction, the broker may recommend an escrow holder. However, it is the right of the principals to use an escrow holder who is competent and who is experienced in handling the type of escrow being requested.

HOW DOES IT WORK:

- In real estate transactions, escrow serves to protect both the buyer and the seller during the home buying process.

- Duties of an Escrow Holder:

- The escrow officer (the third party) follows instructions from the principals (buyer, seller, lender, borrower) and parties involved.

- They handle funds and documents according to these instructions.

- The escrow holder pays authorized bills, responds to requests, and ensures all terms and conditions are met.

- Once everything aligns, the escrow is “closed,” and funds are distributed as instructed.

- An escrow account is established to hold funds for specific purposes, such as:

- Good Faith Deposit: When buying a home, the buyer typically provides a good faith deposit (also known as earnest money) to show commitment. This deposit is held in escrow until the transaction closes.

- Escrow Holdback: Sometimes, funds remain in escrow after the sale due to outstanding bills or other agreements (e.g., allowing the seller to stay in the home for an extra month).

- Taxes and Insurance: After purchasing a home, the mortgage lender sets up an escrow account to pay for property taxes and homeowners insurance. A portion of your monthly mortgage payment goes into this account, ensuring timely payments.

Remember, each escrow situation is unique, but the underlying purpose remains the same: safeguarding the interests of all parties involved in a real estate transaction